Pottawatomie County residents will consider levying a quarter percent sales tax when they head to the polls this November for a host paving and improvement projects on roads and bridges.

Commissioners approved a resolution Monday, two weeks before the state deadline to pose such questions on the general election ballot. Before Monday’s vote, former Public Works Administrator Peter Clark addressed the commission as a representative of the Pottawatomie County Economic Development Corporation’s Board of Directors.

“There’s a number of areas in our county that need to be addressed for the growth that has already occurred, to keep up with that and the growth that has yet to occur, that needs to occur, to keep our county prosperous,” he said.

Clark says the corporation could work as an advocate for the sales tax on the county’s behalf, suggesting a work session could be done ahead of the deadline to help draft wording of the question. State statute prevents county staff from advocating for or against a sales tax initiative.

“There’s ways we can include not just the projects you’re thinking about, but mechanisms for continuing to generate economic growth through this quarter cent sales that we would like you to consider,” he said.

Commissioner Dee McKee favored the idea.

“I think that if they understand the alternatives can still be done the existing budget as we shift off of local roads and stuff like that, very viable. It’s just a full understanding. It’s still still to be developed. I don’t want them to think we don’t need them,” she said.

Commission Chair Pat Weixelman said he was ready to go with the resolution as is.

“I think we’ve got a game plan. I think two weeks from the time it’s coming to fruition and we get it on the books is not enough time to do anything halfway intelligent or study it or anything like that,” he said.

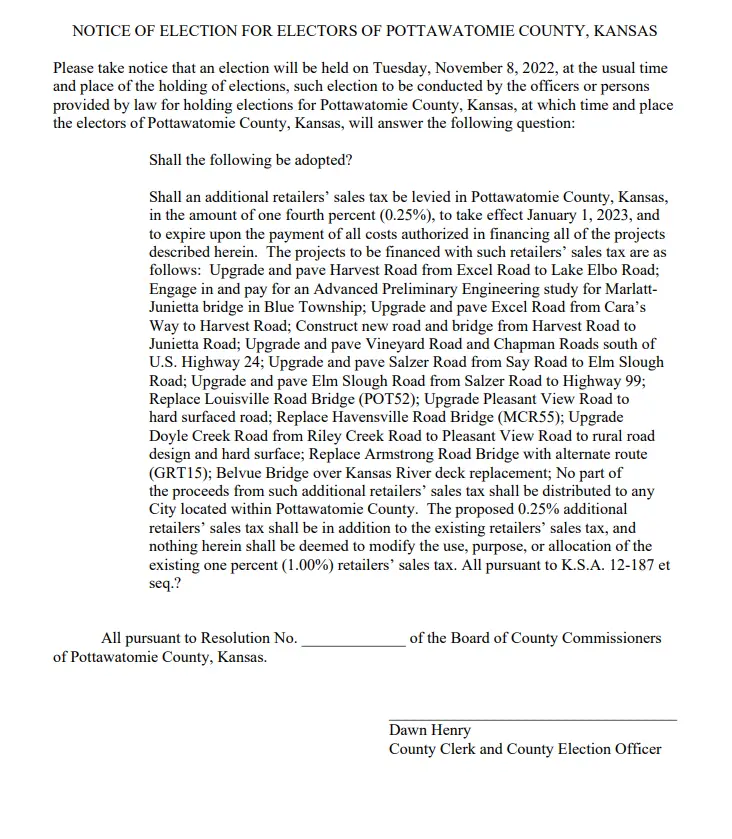

The sales tax would be in addition to the existing 1 percent retail sales tax and would generate about $1.6 million annually to support financing roughly a dozen infrastructure projects throughout the county.

Pottawatomie County and ECODEVO’s board of directors could still work together on promoting the tax to the public moving forward, though nothing has been finalized on that front. Resident watchdog Steve Minton expressed skepticism that any tax would gain broad support from residents.

“It’s going to be a real tough sell with inflation the way it is. People aren’t going to be in the mood to tax themselves more. It’s going to take one heck of a sales job to get it passed,” he said.

The City of Wamego has not publicly discussed the sales tax issue to this point, though it may be brought up during Tuesday’s scheduled meeting in Wamego.