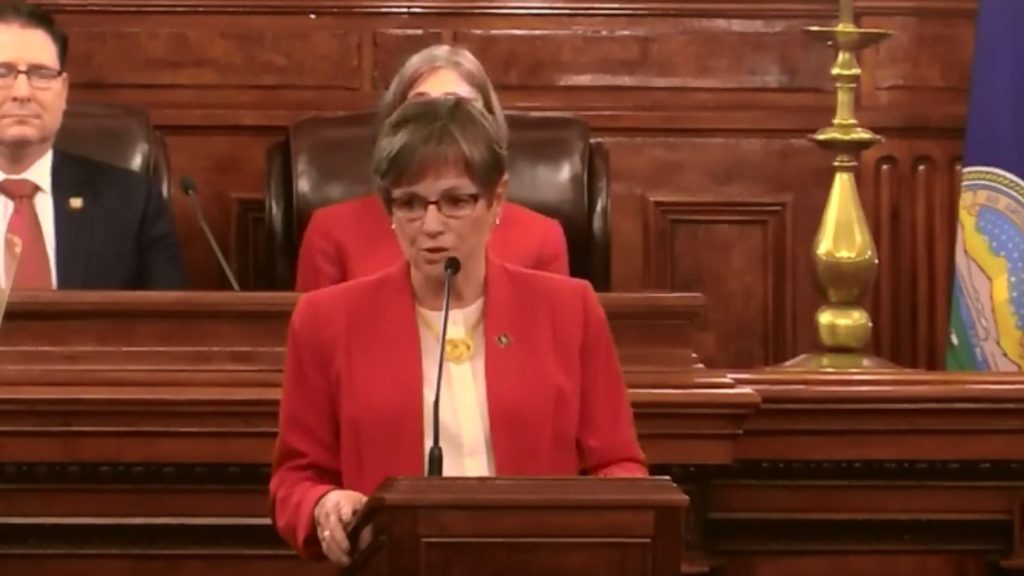

TOPEKA — Kansas Governor Laura Kelly made good on a promise Monday to veto a bill that aimed to change state sales and income tax policy that would reduce state revenue by more than $100 million.

In a statement Monday, Kelly said: “The people of Kansas elected me to rebuild our state. They elected me to bring fiscally conservative and responsible principles back to our government. We must be patient, thoughtful, and prudent as we evaluate tax policy. And, when we move forward with commonsense tax relief, we must ensure that it benefits the Kansans who need it the most.”

Senate Bill 22 was largely split on partisan lines and estimated Kansas would see a decrease in about $187 million due to decoupling from federal tax codes regarding foreign income while raising an additional $21.7 million per year from internet sales. Critics, including Manhattan 66th District House Representative Sydney Carlin estimated the proposal would decimate Gov. Kelly’s proposed budget, at a tune of $495 million over the next three years. 67th District Representative Tom Phillips of Manhattan told News Radio KMAN earlier this month that the bill was driven by federal changes in tax code that came about in 2017 intended to incentivize multi-national companies to repatriate dollars in a one-time event back into the U.S.

Kansas has never taxed foreign incomes previously. The proposal also would shrink the state sales tax on food while broadening the sales tax on out-of-state internet businesses.